What’s Behind Technological Hype?

By Jeffrey Funk

Start-up losses are mounting and innovation is slowing. We need less hype and more level-headed economic analysis.

The percentage of start-up companies in the United States that are profitable at the time of their initial public stock offering has dropped to levels not seen since the 1990s dotcom stock market bubble. Uber, Lyft, and WeWork have incurred higher annual and cumulative losses than any other start-ups in history. All the major ride-sharing companies, including those in China, Singapore, and India, are losing money, with total losses exceeding $7 billion in 2018 alone. Most start-ups involved in bicycle and scooter sharing, office sharing, food delivery, peer-to peer lending, health care insurance and analysis, and other consumer services are also losing vast amounts of money, not only in the United States but in China and India. These huge losses are occurring even though start-ups are remaining private companies twice as long as they did during the dotcom bubble. The size of these losses endangers the American venture capital system itself.

The large losses are easily explained: extreme levels of hype about new technologies, and too many investors willing to believe it. The result is what then-Federal Reserve Board chair Alan Greenspan, commenting on the dotcom bubble in 1996, called “irrational exuberance.” Nobel Laureate Robert Shiller, in his 2000 book of that title, describes the drivers of booms and busts in stock and housing markets, cycles that occurred for stocks during the twentieth century every 10 to 20 years. During a boom, price increases lead to more price increases as each increase seems to provide more evidence that the market will continue to rise. The media, with help from the financial sector, supports the hype, offering logical reasons for the price increases and creating a narrative that encourages still more increases. Rising prices for internet companies in the late 1990s, for instance, led many people to believe that rises would continue indefinitely as the media described a New Age Economy of internet companies that would reorganize product value chains and create enormous new profitability for online businesses. During a bust, the same thing happens in reverse, with a new narrative driving price declines that feed off themselves. Negative hype.

Shiller’s Irrational Exuberance is in full bloom today with a new speculative bubble involving smartphones, algorithms, Big Data, the Internet of Things, artificial intelligence (AI), blockchain, driverless vehicles, and robotics. The narrative began with Ray Kurzweil’s 2005 book, The Singularity is Near, and has expanded with bestsellers such as Erik Brynjolfsson and Andrew McAfee’s Race Against the Machine (2012), Peter Diamandis and Steven Kotler’s Abundance (2012), and Martin Ford’s The Rise of the Robots (2015). Supported by soaring venture capitalist investments and a rising stock market, the world described in these books is one of rapid and disruptive technological change that will soon lead to great prosperity and perhaps massive unemployment. The media has amplified this message even as evidence of rising productivity or unemployment has yet to emerge.

Here I discuss economic data showing that many highly touted new technologies are seriously over-hyped, a phenomenon driven by online news and the professional incentives of those involved in promoting innovation and entrepreneurship. This hype comes at a cost—not only in the form of record losses by start-ups, but in their inability to pursue alternative designs and find more productive and profitable opportunities, and in the inability of America’s decision-makers to acknowledge that innovation has slowed. At the heart of these problems is a lack of good economic analysis, analysis that can guide the nation toward better designs and more productive innovations. My hope is that this discussion will help decision-makers—from individual investors to national policy leaders—recognize hype, avoid its negative effects, and evaluate the economic promise of emerging technologies in more realistic ways. They can then use this realism to improve the way university and corporate research is encouraged, talked about, and carried out.

Innovation is slowing

Robert Gordon, in his important 2016 book, The Rise and Fall of American Growth, shows that productivity growth in the United States was greater and innovations more useful before 1940 than after; productivity growth has further slowed since 1970. Tyler Cowen made similar observations in his 2012 book, The Great Stagnation. Because innovation is the source of most improvements in productivity, 70 years of slowing growth in productivity tells us that we should have lower expectations about innovation’s capacity to contribute to economic growth now than in the past.

Not only is productivity growth in decline, but so is research productivity. A comprehensive study published by the National Bureau of Economic Research found that the number of researchers needed to develop new drugs, improved crop yields, and better microprocessors has risen substantially over the past 50 years. Other studies have found that research and development (R&D) productivity has fallen across a wide variety of industries, with lower growth in corporate revenues per research dollar than in the past, and that the impact of Nobel Prize–winning research has also declined. From a given amount of effort (or dollars), less knowledge and innovation arise. Our optimism about the economic prospects of new technologies and innovation should be going down, not up.

These indicators are widely ignored, in part because we are distracted by information appearing to carry a more positive message. The number of patent applications and patent awards has increased about sixfold since 1984, and over the past 10 years the number of scientific papers has doubled. The stock market has tripled in value since 2008. Investments by US venture capitalists have risen about sixfold since 2001: the total invested in 2018 exceeded the peak of 2000, the last big year of the dotcom bubble, and the number of start-ups valued at more than $1 billion is now in the hundreds, compared with a handful just a decade ago. Such upward trends are often used to hype the economic potential of new technologies, but in fact rising patent activity, scientific publication, stock market value, and venture capital investment are all poor indicators of innovativeness.

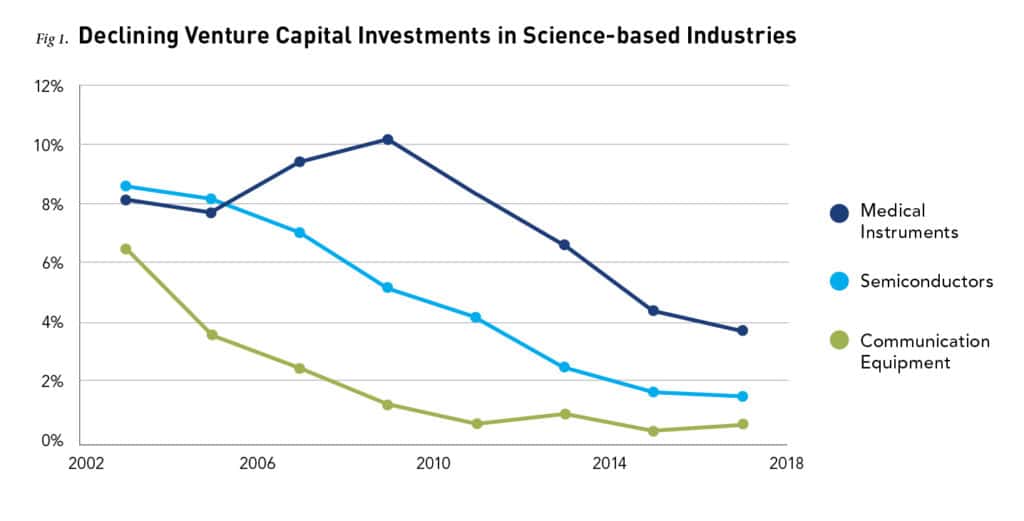

One reason they are poor indicators is that they don’t consider the record-high losses for start-ups, the lack of innovations for large sectors of the economy such as housing, and the small range of technologies being successfully commercialized by either start-ups or existing firms. The vast majority of innovations, by both start-ups and incumbents, involve new forms of internet services (particularly mobile phone apps) and do not include the broad range of science-based technologies that were commercialized many decades ago. For instance, transistors, integrated circuits, lasers, magnetic storage, nuclear power, and LEDs were implemented during the 1950s and 1960s, yet similar types of technologies are being commercialized less and less. Data from PwC’s Moneytree shows that outside biotechnology (and a brief spurt in clean energy between 2008 and 2012), venture capital financings in semiconductors, fiber optic communications, mobile communications, and medical instruments sharply declined between 2002/2003 and 2016/2017 (two-year averages are shown in Figure 1). These falling investments reflect the falling research productivity for microprocessors and other types of science-based technologies mentioned above.

The impact of falling research productivity is also evident in the disappointing results for important science-based technologies such as nuclear fusion and nanotechnology. Nuclear fusion has received more than $30 billion (2017 dollars) in R&D funding from the US government and similar amounts from European countries. Nanotechnology has received more than $20 billion in government support, partly based on a market forecast made by the National Science Foundation in 2001 that pegged nanotechnology to reach a worth of $1 trillion by 2015. But no electricity has yet been generated by nuclear fusion, and the market for the most-hyped nanotechnologies—graphene and carbon nanotubes—is currently far less than $5 billion and barely growing. Despite these examples, however, scientists and engineers continue to make unrealistically optimistic forecasts in leading science and technology magazines such as Scientific American and MIT’s Technology Review, forecasts that have either not materialized or make misleading choices, such as forecasting essentially the same technologies each year with different names.

The sources of hype

For more recent technologies such as artificial intelligence, a major source of hype is the tendency of tech analysts to extrapolate from one or two highly valued yet unprofitable start-ups to total disruptions of entire sectors. For example, in its report Artificial Intelligence: The Next Digital Frontier? the McKinsey Global Institute extrapolated from the purported success of two early AI start-ups, DeepMind and Nest Labs, both subsidiaries of Alphabet (Google’s parent company), to a 10% reduction in total energy usage in the United Kingdom and other countries. However, other evidence for these purported energy reductions in data centers and homes are nowhere to be found, and the start-ups are currently a long way from profitability. Alphabet reported losses of approximately $580 million in 2017 for DeepMind and $569 million in 2018 for Nest Labs.

After years of hype about AI, some traditionally optimistic voices are finally beginning to temper their exuberance. A March 2019 article in IEEE Spectrum argued that Watson, IBM’s AI division, had “overpromised and underdelivered” on personalized health care applications, and shortly thereafter IBM pulled Watson from drug discovery. An April 2019 article in Technology Review went further with a title “This Is Why AI Has Yet to Reshape Most Businesses.” My forthcoming article in IEEE Spectrum (“Why Projections for AI’s Economic Benefits Are Overly Optimistic”) demonstrates that the most-well-funded AI start-ups are not targeting productivity-enhancing applications, and many are likely incurring huge losses.

Similarly, high expectations for clean energy, including solar cells, wind turbines, and electric vehicles, have existed for decades, bolstered by a few market successes such as Denmark’s wind turbines and China’s solar cells. These high expectations have led to calls for government mandates in support of these technologies, particularly in Europe, while ignoring their underlying economics. For instance, analyses of solar and wind often ignore the economics of baseload and peaking plants while those of electric vehicles ignore the troubles encountered by automobile suppliers such as Tesla. Tesla has been losing vast amounts of money for many years with only a few profitable quarters, even though its Model 3 had an average selling price of $57,000 in 2018, about three times higher than the lowest priced conventional vehicle in the United States. Although the cost of car batteries is rapidly falling, market penetration remains modest, and even articles in Nature magazine have been pessimistic about the rate of diffusion of electric vehicles for years.

Whereas people worried about climate change hype electric vehicles, political conservatives and the tech sector hype ride-sharing and driverless vehicles. They argue that ride-sharing services and driverless vehicles will eliminate private vehicles within a few years, with some conservatives asserting that they will make public transportation unnecessary. As reputable a news organization as the BBC posted an article in 2018 titled “Why you have (probably) already bought your last car,” just one example of how mainstream media hypes technologies to get page views. Yet this optimism ignores the high losses by ride-sharing suppliers, their impact on congestion, and the difficulties of driverless vehicles handling every possible contingency.

The numbers I’ve cited—on slowing economic productivity growth, falling research productivity, fewer science-based technologies, and huge losses for start-ups—suggest that we ought to temper our optimism about many hyped technologies.

The amplification of hype

Shiller’s Irrational Exuberance describes economic bubbles in terms of a “psychological epidemic,” and illuminates “why it is so difficult for smart money to profit by betting against bubbles: the psychological contagion promotes a mindset that justifies the price increases, so that participation in the bubble might be called almost rational.” Shiller continues, “a new speculative bubble can appear anywhere if a new story about the economy appears and if it has enough narrative strength to spark a new contagion of investor thinking,” one in which members of the news media “amplify stories that have resonance with investors, often regardless of their validity.” Although Shiller focuses on stock and housing markets, hype about new technologies also involve a narrative that sparks investor thinking and that is amplified by the media.

Hype and its amplification come from many quarters: not only the financial community but also entrepreneurs, venture capitalists, consultants, scientists, engineers, and universities. Venture capitalists have convinced decision-makers in national and local governments, as well as universities, that venture capitalist funding and start-ups are the new measures of their success. Professional and business service consultants hype technology for both start-ups and existing firms in an effort to make potential clients believe that new technologies make existing strategies, business models, and worker skills obsolete every few years. With a fivefold increase in the number of such consultants since 1970, the number of people who have an incentive to hype new technologies continues to rise.

Universities are themselves a major source of hype. Their public relation offices often exaggerate the results of research papers, commonly implying that commercialization is close at hand, even though the researchers know it will take many years if not decades. Science and engineering courses often imply an easy path to commercialization, while misleading and inaccurate forecasts from media outlets such as Technology Review and Scientific American make it easier for business schools and entrepreneurship programs to attract more students by claiming that opportunities are everywhere and that incumbent firms are regularly being disrupted.

Business schools, particularly those that embrace the strategic management discipline, started this hype decades ago by emphasizing that incumbent failure comes from failing to make a technological transition. Harvard University’s Clayton Christensen was the most successful purveyor of this message from the late 1990s with his theory of disruptive innovation. In his theory, new products and services enter at the low end of a market and then, purportedly, displace mainstream ones as demand for the low-end products encourages further improvements—improvements that seem rarely to emerge. The theory was eventually discredited by articles in Sloan Management Review and the New Yorker in the mid-2010s, but the idea of disruption as a common phenomenon lives on.

A key part of these disruptions is a business model that emphasizes how to capture value from an innovation. The strategic management discipline places far more emphasis on capturing value through managing revenue streams (e.g., advertising versus subscriptions or product sales) and the scope of activities (e.g., the degree of vertical integration) than on creating value through high-performing, low-cost products that improve productivity in industries. Currently the most popular method of capturing value is with so-called platforms that organize an industry around a single product or service (think of Airbnb, for example, which offers a platform by which homeowners can rent out rooms), often enabling the platform provider to capture most of an industry’s profits. Not only is value creation clearly more important for increasing productivity than is value capture, it is not a coincidence that most of the current money-losing start-ups (e.g., Uber and Lyft) emphasize platforms in their announcements and IPO filings, building from the hype that business schools created.

Entrepreneurship programs have bundled these messages into a mega-hype that permeates business school activities and advertisements. The number of these programs grew from about 16 in 1970 to more than 2,000 in 2014. In addition to focusing on value capture and platforms, they emphasize the vision and genius of entrepreneurs and profess that experimentation is more important than careful economic analysis. For instance, in an influential 2014 paper about entrepreneurship, three Harvard professors argued that the “probabilities of success are low, extremely skewed, and unknowable until an investment is made,” thus encouraging anyone with an idea to run with it, and without doing much economic analysis.

Hype from these types of experts is exacerbated by the growth of social media and an increasing number of technology news, investor, and consulting websites. TechCrunch, The Verge, TechRadar, Mashable, CNET, CBInsights, and The Motley Fool are just some of the websites that focus heavily on technology news, particularly for investors whose importance has increased as venture capital fundraising and stock market investing have exploded. Narrowly focused news sites that serve specific technologies (e.g., CoinDesk, Teslarati, Dronelife) also proliferate and share their articles and reports on LinkedIn, Facebook, and Twitter. These trends are magnified by the rise of online sponsored content and native advertising, both with the look and feel of news written by independent journalists even though they aren’t. The amount spent on these new forms of advertising now exceeds that spent on traditional website banner advertising. These online news stories can often keep a technology’s hype going after the print media would have lost interest, as documented with the hype around nanotechnology.

Online tech-hyping articles are now driven by the same dynamics as fake news. Journalists, bloggers, and websites prioritize page views and therefore say more positive things to attract viewers, while social media works as an amplifier. Journalists become “content marketers,” often hired by start-ups and universities to promote new technologies. Entrepreneurs, venture capitalists, university public relation offices, entrepreneurship programs, and professors who benefit from the promotion of new technologies all end up sharing an interest in increasing the level of hype.

Sometimes the beliefs behind political and technology hype merge. Think of libertarians who love cryptocurrencies, defense hawks who love new fighter jets, adventurers who think space travel is human destiny, train buffs who love hyperloop, health care professionals who love any technology that might prolong lives, anticorruption crusaders who love blockchain, social entrepreneurs who love financial technology (fintech), and environmentalists who love renewable energy and electric vehicles. Many of these special interest groups often believe their overall goals are far more important than more practical issues such as cost, performance, economic feasibility, and profitability, a problem made worse by the increasing polarization of the American public along ideological lines. As these special interests push their technologies on social media sites such as Twitter, LinkedIn, and Facebook, they create echo chambers in which people repeat the same message until it becomes an unquestioned mantra, even though few economic details are presented.

And when one overhyped technology fails to solve the world’s problems, there is always another waiting to be hyped. Train buffs replaced magnetically levitated trains with hyperloop, social entrepreneurs replaced microfinance (remember Nobel Peace Prize winner Muhammad Yunus?) with fintech, drug companies replaced stem cells with gene editing, and environmentalists have forgotten about nuclear fusion, solar water heaters, hydrogen vehicles, and cellulosic ethanol. Hype-driven economic disappointments seem never to dampen enthusiasm for new cycles of irrational exuberance.

Better economic analysis is needed

There is much that managers, investors, journalists, policy-makers, and others can do to assess the economics of emerging technologies and reduce the surrounding hype in order to determine where their support should go. To begin, they can inquire about existing implementations. Has the technology been implemented, what are customers saying, what is the financial status of the suppliers? Are there one, ten, or one hundred implementations, and what do their experiences (including the customer feedback and supplier financials) indicate about future ones? Are there large numbers of similar applications just waiting to be implemented in the future, or only a few niche ones? Computers playing chess seems relevant to just a few niche applications, while successful examples of machine learning through Watson, for example, would be more relevant to the overall field of health care.

Second, decision-makers must consider both the value proposition and the cost structures for the new and old technologies. How much of an advantage does the new technology offer? For instance, although ride-sharing services are more convenient to access than taxis, they have the same cost structure and use the same types of vehicles, drivers, and roads—only the algorithms and phones are different. These services also contribute to congestion just as taxis do. This suggests that ride sharing will not improve productivity and that improved profitability will require either higher prices or further reductions in the wages of drivers.

Hyperloop, while providing faster speeds, shows few other advantages over magnetically levitating trains, an old and unsuccessful technology. In hyperloop, passenger pods are magnetically levitated above superconducting rails and pushed through steel tubes by electric motors. Its main technological improvement is the addition of steel tubes and a partial vacuum, but these also make it much more expensive. A key question is whether hyperloop’s faster speeds justify the added cost and enable hyperloop to be cost effective when magnetically levitating trains are not.

Third, are improvements occurring that will positively affect the cost structure? New technologies always have problems, but the real question is whether there is progress toward a viable solution in terms of cost and performance. Sometimes the improvements are qualitative and therefore hard to measure. Other times, decision-makers can use quantitative measures to judge the feasibility of the technology. For example, Moore’s Law (which basically holds that the overall processing power for computers will double every two years) has been a measure of progress for integrated circuits and a signal for new applications for more than 50 years (but is now slowing). Similar measures of progress exist for almost every other successful technology including computers, LEDs, lasers, and hard disk drives, and for uncommercialized technologies such as high-temperature superconductors, quantum computers, and quantum dot solar cells.

Compare ride sharing to e-commerce. E-commerce services (and Amazon) benefited from faster and cheaper internet services that made it economical to place image and video files on websites, thus expanding the market from books to clothing and other products whose aesthetics affect purchasing decisions. But what technologies are improving the economics of ride sharing? Better phones and Big Data might enable new forms of ride sharing, but they have little relevance for existing services. Cheaper phones have meant more people can access ride-sharing services, but they don’t increase the productivity of cars, drivers, or roads, nor will they solve the congestion problem, unless dramatically different services are implemented. If there are no improvements occurring, why would the economics of ride sharing, or any other technology, improve?

Fourth, for a technology still early in development, decision-makers must look for similar technologies that might provide insights into the new technology’s economics. For instance, magnetically levitated trains and Big Data can provide insights into the economics of hyperloop and AI respectively. Both suggest pessimism. When proponents are touting the benefits of a new technology, decision-makers must challenge them to make these types of comparisons. Unfortunately, few decision-makers have the expertise to challenge proponents, reflecting in part at least the fact that university training in economics, business, and engineering almost never includes serious exposure to the economics of innovation and new technologies. Without this training, decision-makers will likely continue to fall for the hype of proponents, often shrouded in technical and business jargon.

Fifth, decision-makers should ask about the possible sources of economic performance improvements. Proponents may talk of learning curves and other improvements that will occur once production starts, but the effects of scale and new product and process designs differ by industry and from one technology to another. For any hyped technology, one should try to understand the impact of scale, the potential for new product and process designs, and their likely impact on cost and performance. Moore’s Law and improvements in other electronic technologies over the past 50 years have enabled many high-level products and services to be commercialized; however, outside information technology (and perhaps batteries), there are few examples of technologies experiencing rapid improvements that can justify long-term optimism.

What universities can do

Hype wastes resources and time and distracts from more plausible pathways for improving productivity or solving social problems. Diminishing productivity growth, falling corporate R&D productivity, and the declining value of Nobel Prize–winning research are real challenges that require careful thought and analysis. Hype makes it harder for scholars to address these problems in a careful, thoughtful way because it misleads them into thinking that productivity will get back on track once growth in AI surges, blockchain takes off, Uber and Lyft refine their business models, and so on. After all, if experimentation is the only way forward, as the three Harvard professors argue in their paper on entrepreneurship, why bother with trying to change the way things are done and instead just encourage more experimentation?

For instance, returning productivity to the high growth years before 1970 will require more science-based technologies to be commercialized, as they were in the glory years of the 1950s and 1960s when transistors, integrated circuits, lasers, magnetic storage, nuclear power, and LEDs were implemented. Falling research productivity likely means that there are fewer of these technologies being commercialized. But the current hype around new technologies prevents many people from acknowledging the decline, thereby preventing us from reversing it by doing things differently. For instance, perhaps the decline of the major corporate R&D labs in the past 75 years, and the expectation that universities would take up the slack, is a reason for fewer science-based technologies being commercialized. This change has driven increases in the number of scientific papers, but not the emergence of many new science-based technologies.

At a more micro level, hype also prevents us from successfully commercializing many of the technologies being struggled with by money-losing start-ups because growth has been prioritized over profits, value creation, and new designs. For instance, ride-sharing could have been implemented in a number of different ways. Start-ups could have used Big Data to work with public transportation companies to identify better routes and schedules—for example, ones that vary throughout the day as traffic patterns change and that have fewer stops than previous ones—and to use different sized vehicles and not just large buses. But these types of services were not considered. Hype and its resulting obsession with growth over economic analysis and value creation pushed everyone down the same path in a race to achieve scale and network effects.

How might we counter this hype while still encouraging an innovative society? One place to start is to hold experts, including social scientists, journalists, and business consultants, accountable for bad forecasts. Research on forecasting has found that holding forecasters accountable for the quality of their predictions can improve the predictions in many ways. Evaluating the output from past forecasts while being critical of current forecasts that don’t provide sufficient evidence might not only put a brake on irrational exuberance; it might contribute to better-quality information and decisions. Academics and the media should periodically assess the accuracy of forecasts, their own and those of others, to see which forecasts provided the most accurate and insightful analyses. A useful example of a good assessment is one done of Herman Kahn and Anthony Wiener’s 1968 forecast of technologies for the year 2000, published in a 2001 paper by Richard Albright. Philip Tetlock, a coauthor of Superforecasting: The Art and Science of Prediction, is doing similar historical assessments of technology forecasts at the University of Pennsylvania.

Another way to fight hype is to focus on better measures of organizational success—specifically, on output not input. Rather than evaluate regions by the amount of venture capital spending they obtain, and rather than judge universities by the number of start-ups they create or R&D funding they attract, it might be better to focus on their contribution to new products and services or on the number and size of profitable start-ups they create over the long run. This will require more work and involve a longer time lag, but the results will more likely reflect true innovation and solid economic growth.

Finally, universities need to promote better accuracy in their research announcements, acknowledging the long development times, explaining the reasons for them, and illuminating the process by which new technologies become economically feasible. The reality is that few technologies experience the types of improvements necessary for commercialization. Discussions of the paths to successful commercialization must go beyond simplistic distinctions between basic and applied research and help decision-makers understand the levels of cost and performance needed for commercialization and the means of achieving them.

The economics of new technologies as well as existing ones should also be emphasized in science, engineering, and business courses. The hidden costs of roads, parking lots, and congestion for transportation; insurance paperwork for health care; the system of baseload and peaking plants for electricity; high transport and labor costs for recycling; and the relationship between height restrictions and urban housing costs are just some examples of cost problems that innovation must address and that are rarely emphasized in academic courses. Science and engineering courses must, in addition to preparing students to make scientific and technological advances themselves, help students understand the economics and business of real science-based technologies—giving their natural optimism a good dose of pragmatism and perspective.

From superconductors to fusion, bioelectronics, quantum dots, perovskite solar cells, and quantum computing, real stories can be told about cost and performance challenges, the trade-offs between them, and the slow improvements toward overcoming these challenges. Addressing such issues can help policy-makers and managers make smarter investment decisions. And telling such stories makes it easier for students, managers, and policy-makers to avoid hype and the wasted effort it spawns—and ultimately will enable them to explore avenues of innovation much more likely to lead to real economic growth.

from Hacker News https://ift.tt/2Vym4Ex

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.