You may think of white-collar criminals as extravagant Wolf of Wall Street types with extreme personalities and habits that make them easy to spot. However, real corporate criminals are much more normal, and much more common, than you might realize. Statistically, regular employees with friends, families, and spotless records are much more likely to commit fraud than those who demonstrate clear red-flag behaviors.

What else don’t you know about corporate criminals? Dig into the data we’ve compiled to learn more about the fascinating (and sometimes frightening) world of white collar crime.

Contents:

Who Commits White-Collar Crime?

1. A gender breakdown of defendants in financial scandals from 2001 – 2018 found that just 7% of those involved were women. (White-Collar Crime: An Opportunity Perspective)

2. Three-quarters of white-collar criminal offenders are white males. (University of Cincinnati School of Criminal Justice)

3. Over half (62%) of white-collar criminals are married, and 50% own homes. (University of Cincinnati School of Criminal Justice)

4. About half of occupational fraud perpetrators have a university degree. (2020 Global Study on Occupational Fraud and Abuse)

5. Ninety-four percent of white-collar crime perpetrators are the only criminals in their family. (University of Cincinnati School of Criminal Justice)

6. The average white-collar criminal is 41 years old. (University of Cincinnati School of Criminal Justice)

7. Occupational fraud is most common among individuals who have spent 1-5 years with their employer. (University of Cincinnati School of Criminal Justice)

8. Thirty-nine percent of fraud perpetrators at non-profit organizations are owners or executives. (2020 Global Study on Occupational Fraud and Abuse)

9. According to a 2020 survey, 37% of crimes experienced were committed by an internal perpetrator while 20% were the result of collusion between internal and external perpetrators. (PwC, 2020 Global Economic Crime and Fraud Survey)

10. Of those crimes committed by an internal perpetrator,

11. Frauds committed by people who were invited in—such as employees, executives, vendors, suppliers, partners, etc.—represent nearly half of all frauds reported. (PwC, 2020 Global Economic Crime and Fraud Survey

Prevention and Detection

12. One in three cases of occupational fraud are caused in part by a lack of internal controls. (2020 Global Study on Occupational Fraud and Abuse)

13. The #1 way that occupational fraud is initially detected is via tip. Half of all tips come from employees, while 22% come from customers and 15% are anonymous. (2020 Global Study on Occupational Fraud and Abuse)

14. Organizations with fraud hotlines detect frauds 33% faster than those without hotlines. (2020 Global Study on Occupational Fraud and Abuse)

15. The average fraud case lasts 14 months before it’s detected. (2020 Global Study on Occupational Fraud and Abuse)

16. Nearly one-third of embezzlement schemes last three years or longer before detection. (2018 Hiscox Embezzlement Study)

17. The top four methods of fraud concealment used by perpetrators are creation of fraudulent physical documents (40%), alteration of physical documents (36%), alteration of electronic documents or files (27%), and creation of fraudulent electronic documents or files (26%). (2020 Global Study on Occupational Fraud and Abuse)

18. In 52% of occupational fraud cases, a background check was run on the perpetrator prior to hiring. Just 13% of those checked had red flags in their background report. (2020 Global Study on Occupational Fraud and Abuse)

19. Eighty-nine percent of fraud offenders have never been charged or convicted of prior fraud. (2020 Global Study on Occupational Fraud and Abuse)

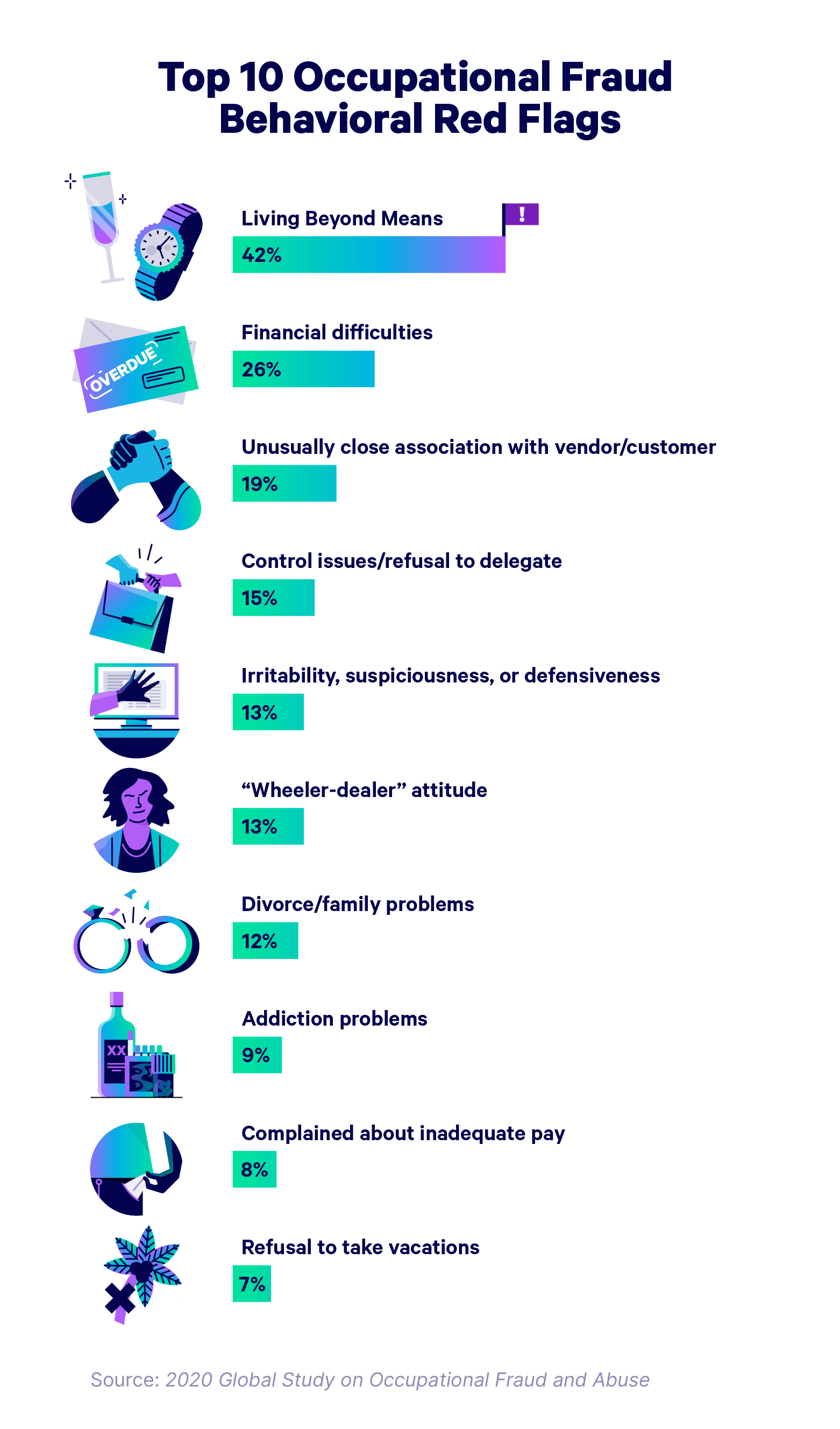

20. Fifteen percent of fraud perpetrators showed zero red flag behaviors prior to being caught. (2020 Global Study on Occupational Fraud and Abuse)

21. About 4 in 10 (42%) of occupational fraud offenders were living beyond their means, and 26% were experiencing financial difficulties when they were caught. (2020 Global Study on Occupational Fraud and Abuse)

Types of White-Collar Crimes

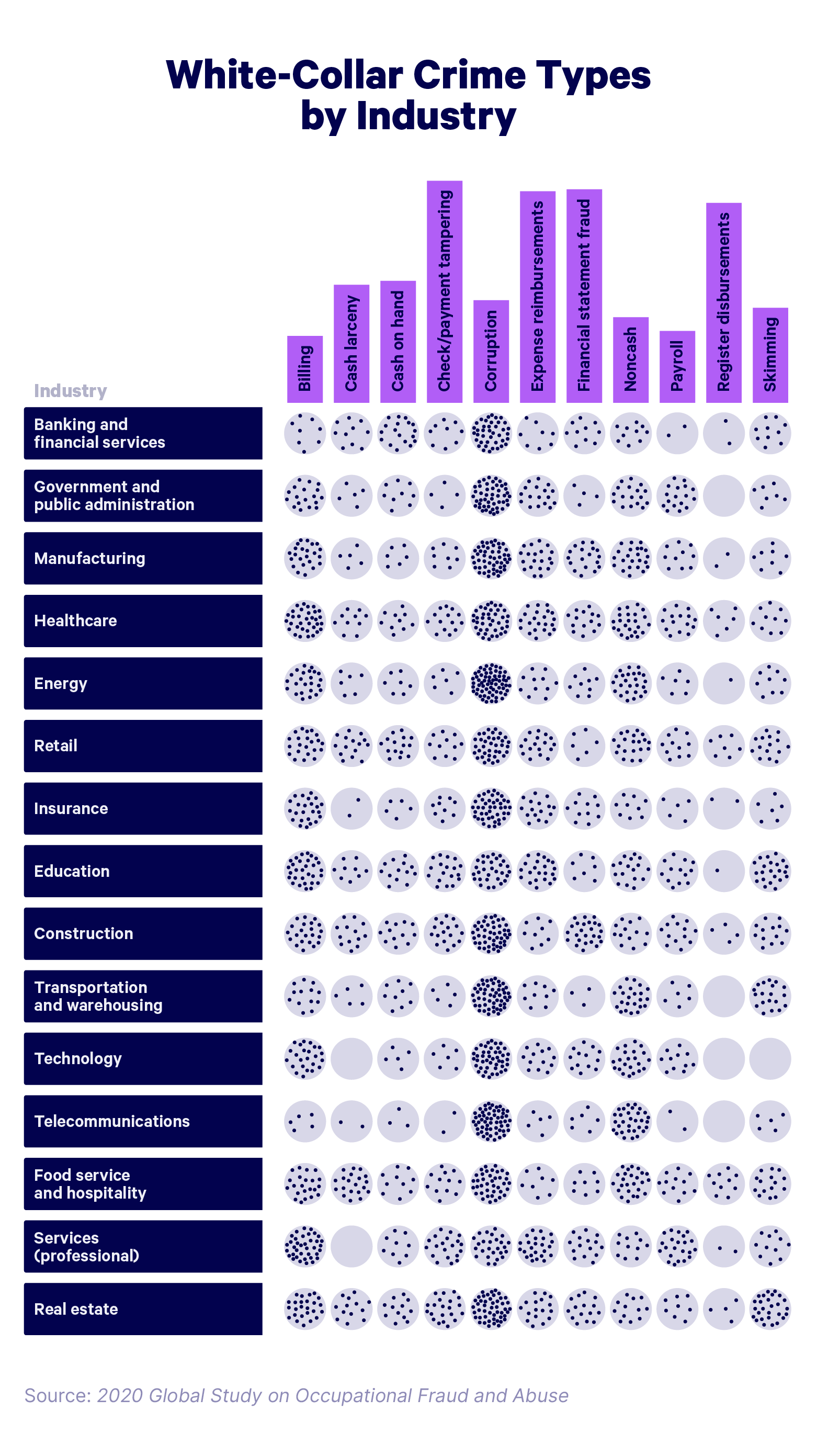

22. Asset misappropriation schemes are the most common and least costly type of occupational fraud, at 86% of cases with a median loss of $100,000. (2020 Global Study on Occupational Fraud and Abuse)

23. Financial statement fraud schemes are the least common and most costly type of occupational fraud, at 10% of cases with a median loss of $954,000. (2020 Global Study on Occupational Fraud and Abuse)

24. The average embezzlement case results in over $350,000 in losses. (2018 Hiscox Embezzlement Study)

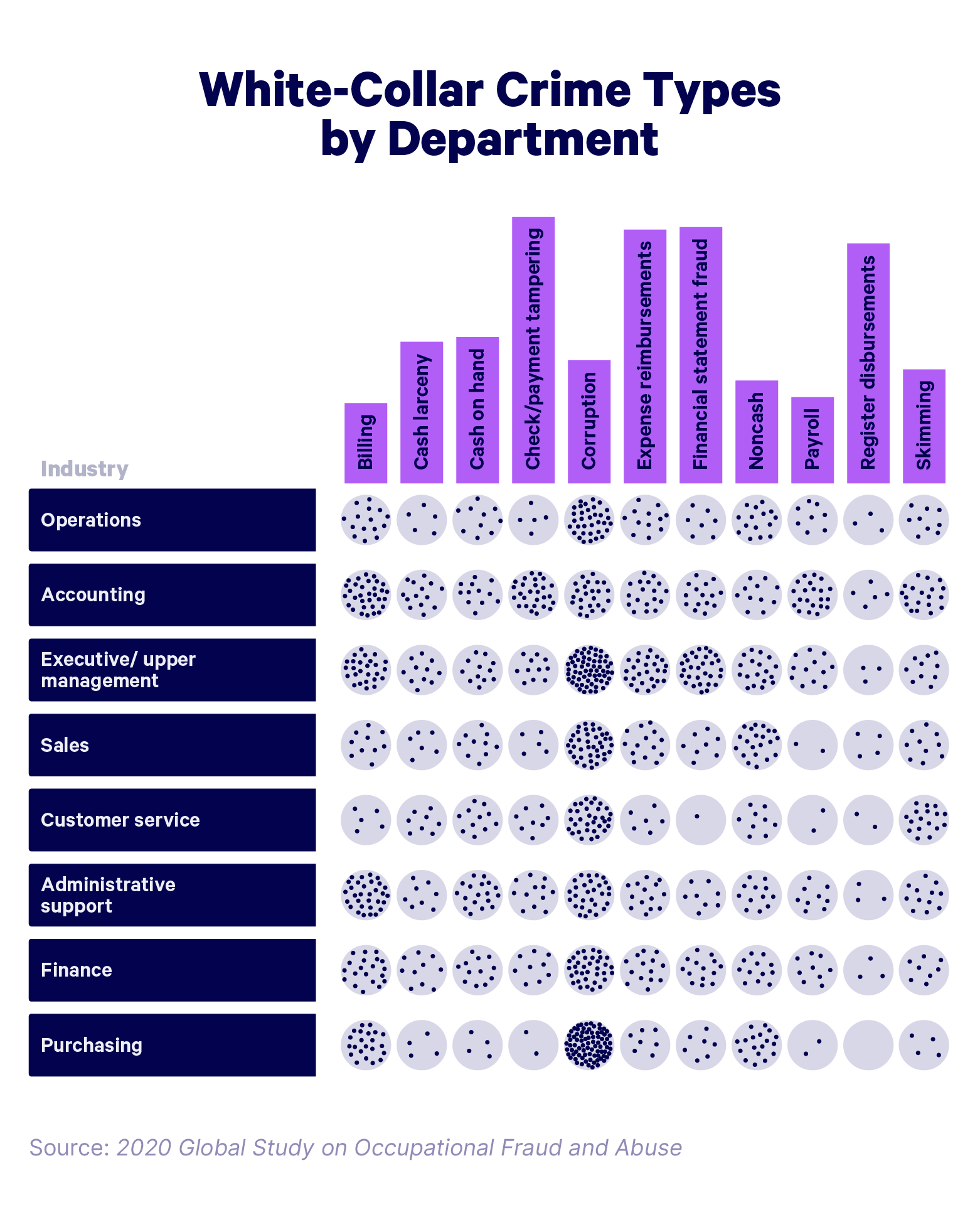

25. Billing fraud, payment fraud, and check or payment tampering are all more common in small businesses than at large organizations. (2020 Global Study on Occupational Fraud and Abuse)

26. Florida has the highest number of convicted money launderers, followed by New York and Texas. (United States Sentencing Committee)

27. The average sentence for money laundering is 64 months. (United States Sentencing Committee)

28. Fraud is the most common offense among organizational offenders (corporations, partnerships, unions, trusts, pension funds, and non-profit organizations). (United States Sentencing Committee)

White-Collar Crime Prosecutions

29. Only 56% of organizations conducted an investigation of their worst incident, and less than a third reported it to the board. (PwC, 2020 Global Economic Crime and Fraud Survey)

30. Nearly half of victim organizations decline to refer cases to law enforcement because decision makers believe internal discipline is sufficient. (2020 Global Study on Occupational Fraud and Abuse)

31. The maximum prison sentence for insider trading is 20 years, and the maximum criminal fine for insider trading is $5 million for individuals and $25 million for organizations or “non-natural persons.” (U.S. Securities and Exchange Commission)

32. The top three parties that whistleblowers report to are direct supervisors (28%), fraud investigation team (14%), and internal audit (12%). (2020 Global Study on Occupational Fraud and Abuse

White-Collar Crime Costs

33. The FBI reports that white-collar crime costs the United States over $300 billion per year. (Cornell Law School)

34. According to the Association of Certified Fraud Examiners, fraud costs businesses in the United States 5% of their annual gross revenue on average. (2020 Global Study on Occupational Fraud and Abuse)

35. By comparison, common crimes like burglary, larceny and theft cost just $16 billion per year. (FBI)

36. In 2020, 43% of reported incidences of fraud that resulted in losses of over $100 million were committed by insiders. (PwC, 2020 Global Economic Crime and Fraud Survey)

37. The average loss per fraud case is over $1.5 million, and the median loss per case is $125,000. (2020 Global Study on Occupational Fraud and Abuse)

38. Frauds committed by owners or executives result in an average loss of $600,000. (2020 Global Study on Occupational Fraud and Abuse)

39. The median loss for fraud cases is $150,000 among those committed by men and $85,000 among those committed by women. (2020 Global Study on Occupational Fraud and Abuse)

40. The market for anti-money laundering software is predicted to grow by over $2 billion by 2025. (TechNavio)

41. In 2020, the median loss from securities and investments fraud cases was over $2.1 million. (United States Sentencing Committee)

42. Law enforcement uncovered $3.25 billion in Ponzi schemes throughout 2019—more than double the amount uncovered in 2018 and the largest single-year amount uncovered since 2010. (Ponzitracker)

from Hacker News https://ift.tt/cZ4uNDY

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.