There are about a million and one different angles to consider when talking about the big story in the stock market.

The most important thing that’s happening is the deterioration of faith that people have in financial institutions. Once trust is lost, it’s almost impossible to gain it back. Memes aside, this is no laughing matter.

A listener I’ll call Jimmy asked us to comment on this:

My wife recently came into a large sum of money about two weeks ago. She played it wisely and invested the money for the long-term in S&P equities and mutual funds. She followed the playbook perfect – didn’t try to time the market, didn’t make any large purchases, etc.

As a lifelong populist and supporter of any movement that increases the equality of financial opportunities, I was initially excited to see the trend behind GameStop this week. Nontraditional investors beat the crap out of “professional” WallStreet hedge fund speculators at their own game. I was also shocked when the hedge funds pressured the brokerages to disallow new stock purchases of GameStop, thereby changing the rules of the game in the fourth quarter because they were losing.

Over the past few days, I truly believe the success of the GameStop “micro-bubble” has forced many hedge funds out of their long-term positions to cover their losses, which has had a negative effect on the S&P as a whole. Seeing my wife lose money as a result of the hedge funds foolish shorts and inability to adapt to a new wave of social media – as well as the frightening thought the trading can be halted at any time as the brokerages see fit – has caused me to become extremely disheartened toward investing in the future. Sadly, we are thinking about taking her money out of the market all together and putting into an investment that is less manipulated and volatile.

I’ll do my best to unpack this quickly and then make my point.

Hedge funds have idea dinners in private behind closed doors. The people at WSB did this out in the open for everyone to see. And it worked. And when the brokers came out last week and interfered with people’s ability to execute orders, I’ve never seen so many people with different beliefs come together. Everyone from Ted Cruz to AOC to Aaron Rodgers sided with Main Street against Wall Street.

The idea that outsiders can stick it to the man resonates with all of us.

The events of the last week are forcing us to talk about reforming things that, frankly, desperately need it. People are debating ideas surrounding payment for order flow, different tax rates for different holding periods, carried interest, and disclosures, to name a few.

I love what started as David versus Goliath, but I’m starting to get worried. I’m worried that people who are already skeptical of the system will leave and never come back. I’ll get to that in a minute, but first, a quick word on the video game retailer.

GameStop started out as a deep value play and has grown into something far bigger than anyone could have imagined. It’s become about far more than money. It’s now a movement where an army of outsiders are coming together for one common purpose, to stick it to the man. Mission accomplished. Sort of.

Melvin Capital, the fund that was targeted by WSB, lost 53% in January! The typical long/short fund lost 7% last week, a massive loss in a week for these types of strategies. These hedge funds are players just like WSB are. Bigger players to be sure, but they’re all operating in the same house, and the house always wins.

The house, in this case, is Citadel, a large hedge fund that runs a market maker called Citadel Securities.

I’m not about to side with or defend Citadel, not that they need my defense, but I do not believe they had anything to do with Robinhood and other platform’s decisions to shut down trading. They have too much to gain from retail to step in front of it, despite their capital injection into Melvin, which admittedly looks incredibly shady to an outside observer 1. And the fact that Janet Yellen, the new Treasury Secretary, got paid hundreds of thousands of dollars in speaking fees from Citadel doesn’t help either. But neither of these two parties are responsible for what happened on Thursday and Friday.

29% of GameStop’s trading volume last Monday through Thursday was handled by Citadel Securities, according to this WSJ article. They state that Citadel Securities’ revenue, which is separate from Ken Griffin’s hedge fund that invested in Melvin, did $6.7 billion in revenue in 2020, thanks to the explosion in retail trading accounts. There would be no reason for them to make a call to Robinhood or any of the other brokers. It’s not in their financial interest to do so. How do I mean? Well, if they do 29% of GameStop trading, then according to some back of the envelope math by Eric Balchunas, they made $100 million on one stock last week.

So if it wasn’t the hedge funds, then what the hell happened? Simply put, the financial system was not built for the type of activity we saw last week. It might be a bit hyperbolic to say that the knees buckled, but it got hit one too many times and was on the brink of something dangerous.

So whose decision was it? It wasn’t regulators as far as we know, it wasn’t hedge funds, and it wasn’t Robinhood. It was the clearing firms that pulled the ripcord. A clearing house is responsible for all the reconciliation after a trade occurs, and with the speed at which securities were changing hands, they got overheated. The intricacies of how these firms operate is a complicated topic that, frankly, I know very little about. Click here for a relatively simple explainer, and here’s one that will bury you in detail.

I understand why there was mass outrage from Robinhood users, but I don’t think there was anything nefarious going on. This was an epic failure to communicate. Because emotions are supercharged right now, I want to reiterate that I’m not siding with Robinhood here. I understand why its customers responded the way they did. I’m only saying that this was not some massive conspiracy, and it’s important to say this because it leads me to the part of this whole story that is the most troubling to me, which Jimmy hit on.

“Sadly, we are thinking about taking her money out of the market all together and putting into an investment that is less manipulated and volatile.”

You’re right, Jimmy. Insiders have advantages. I understand that it feels like parts of the system are broken. I understand that it feels unfair. I understand that it feels like the odds are stacked against you.

But I’m asking you to please reconsider.

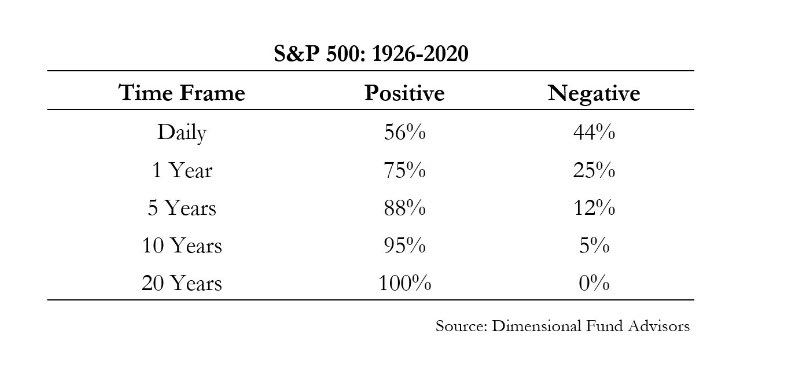

I’m thrilled for the people that got in early and made boatloads of money. But the people who are getting in late will be left holding the bag. And when they do, they will go looking for people to blame. The “system is rigged” will be shouted out when what will really happen is the market’s inherent rejection of rewarding get rich quick strategies. If you play their game, and this is their game, you will not win. But Jimmy, if you take a long-term view, then you almost can’t lose. 2

Right now, people are getting rich quick. But this will not last forever. And the worst thing about trying to get rich quick, aside from the fact that it usually backfires, is that when it doesn’t work, you’ll say that the game was rigged and leave forever. Jimmy, please do not go down this road. Do not cut off your nose to spite your face. If you want to win, then play a different game.

Long-term investing is boring. It makes watching the grass grow look like an Avengers movie. But if you can hang in there for better and for worse, you will not regret it.

I can’t promise you that it will be easy. I can’t even promise that risk will be rewarded, but I can promise you that sitting in cash is a sure way to lose. I hope you will reconsider.

1. Citadel lose less than 1% from its investment in Melvin and fell just 3% during the month

2. Japan, I know. Now is not the time.

from Hacker News https://ift.tt/3tdmoc6

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.