Samsung

A global deceleration of laptop sales is being linked in a new report from market research firm Trendforce to increasing vaccination rates and a corresponding decrease in remote work and remote learning. According to the findings, demand for Chromebooks slid by over 50 percent during one month since July. And notebook shipments for the remainder of the year are expected to be affected by the COVID-19 pandemic and the shifting demand from businesses.

Trendforce said that interest for ChromeOS-powered laptops within the last year had primarily been driven by remote learning. The analyst pointed to rising vaccination rates in North America, Europe, and Japan throughout the second half of 2021 as recently slowing demand for Chromebooks.

After being a “primary driver” of overall laptop shipments in the first half of 2021, Chromebook shipments dropped by over 50 percent during one month in the second half of the year. And because Chromebooks represent a “relatively high share” of HP's and Samsung’s overall laptop shipments, the OEMs’ shipments are predicted to fall by 10 to 20 percent from the first half of the year to the second half.

Still, it’s not all downhill from here for Chromebooks—Trendforce still expects a total of 36 million devices shipped in 2021.

“The US FCC released the Emergency Connectivity Fund, which totals US$7.17 billion, in July in order to facilitate the purchase of such equipment as notebooks, tablets, and network connectivity devices by schools and libraries,” Trendforce said. “This fund will likely sustain the demand for Chromebooks for the next year.”

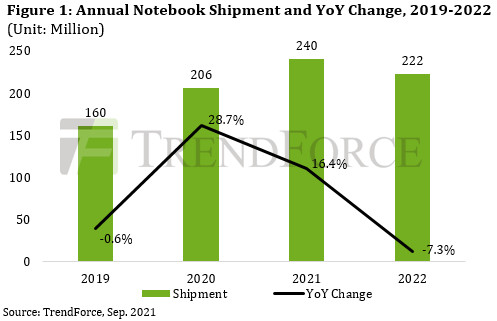

Laptop shipments are expected to hit 240 million this year.

Overall, Trendforce thinks laptop shipments will see a 16.4 percent year-over-year increase in 2021 for a total of 240 million systems.

Q4 in question

At best, Q4 shipments will be on par with Q3’s numbers, Trendforce predicted. But one disadvantage Q4 has compared to Q3 is that the latter's numbers were aided by laptop brands hurrying to get Q4 shipments out early in order to avoid port traffic. The return of workers to offices in North America and Europe is fueling demand, but the researcher is unsure if the commercial laptop trend will be as strong in Q4 as it was in Q3.

If commercial demand does continue trending upward, Dell should be happy, since it sees a higher market share from its commercial laptops than “any other brand,” according to Trendforce. The research firm expects Dell's commercial laptop shipments to grow by 20 percent from H1 to H2.

Laptop shipments in Q4 are also expected to get a boost from people upgrading in order to enjoy things like Intel’s next-gen CPUs or Windows 11, which debuts next week (although, remember, you don’t need to buy a new PC to upgrade to Windows 11). However, final numbers will also be impacted with where the world is with the COVID-19 pandemic.

All the while, the laptop supply chain is still bogged down by limited components stock, including integrated circuits for Wi-Fi modules, USB Type-C power delivery, and power management. Additionally, 14- and 15.6-inch screens using IPS panels and 1920×1080 resolution are also limited. The good news is that lower-resolution TN panels in those sizes are starting to meet demand, while 11.6-inch panels are getting cheaper. Trendforce predicted that notebook panel supply and demand will reach “equilibrium” in Q4.

Come 2022, vaccinations should be even more prevalent, and Trendforce believes laptop shipments will decrease 7 to 8 percent, year on year, to an estimated 220 million units. Even if that trendline points down, note that's still an improvement over the 160 million units shipped in 2019 ahead of the pandemic.

from Hacker News https://ift.tt/3CYoLDy

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.