Companies abide by generally accepted accounting principles (GAAP) when they prepare and report financial statements. Almost all companies also provide some kind of adjusted non-GAAP earnings that take out one-time expenses and other expenses which they believe provide a more accurate reflection of their performance, but typically the difference in GAAP and non-GAAP earnings in most periods is small.

For many tech companies the difference between the reported GAAP earnings, and their adjusted non-GAAP earnings is often very large. This is primarily because they exclude stock-based compensation in these-GAAP figures, something which I think is pretty egregious. Why? Let’s dive in.

What is Stock-based Compensation?

Most tech companies use stock-based compensation (also known as equity compensation) to attract and retain employees.

They typically take two forms: options which are granted at a given strike price or Restricted Stock Units, both of which tend to have a cliff (before which the employee gets nothing) and vest over a period in order to align incentives and help retain employees.

Why offer Stock-based Compensation?

Stock-based compensation has some clear benefits. One, they give employees and senior management some skin in the game and can help align incentives to focus on long term value creation. Two, since they come with vesting schedules (often four years), they help retain employees. Three, they allow for companies which are cash-poor to conserve cash and yet compensate employees in another form, and therefore attract and retain talent.

Accounting for Stock-based Compensation

Until 2004, companies were not required to expense the fair value of the option grants they gave employees. Instead, they had the option to just disclose the fair value of these options in a footnote. However, in 2004, the Federal Accounting Standards Board changed the standards and required that companies value stock options based on their fair value and record them as an expense on their grant date.

This move was controversial at the time as some people pointed to the fact that stock-based compensation is a non-cash expense. In addition, others mentioned that stock-based compensation dilutes shareholders and is therefore already accounted for by virtue of the number of shares outstanding increasing.

But GAAP rules are GAAP rules, and so companies have to expense stock-based compensation in GAAP accounting.

However, many tech companies have chosen to remove stock-based compensation when they provide their non-GAAP estimates. In addition, many tend to provide quarterly and yearly guidance and long-term margin and other targets on non-GAAP rather than GAAP estimates.

Does it Matter?

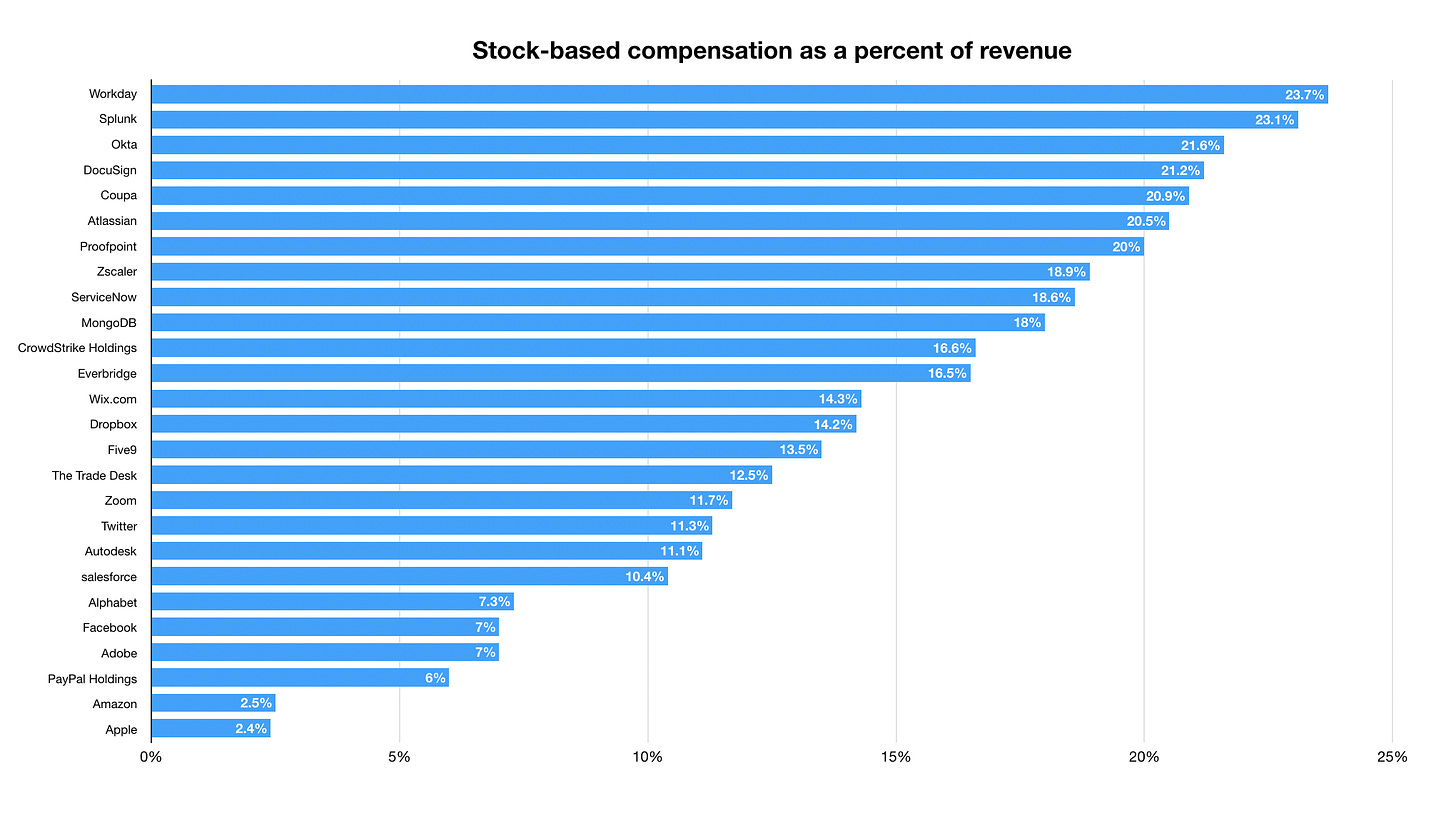

One obvious question to ask is whether stock-based compensation is large enough to even worth caring about. As the chart below shows, the answer is a resounding yes.

For many tech companies, SBC as a percent of revenue is well in the double digits, as the chart below highlights.

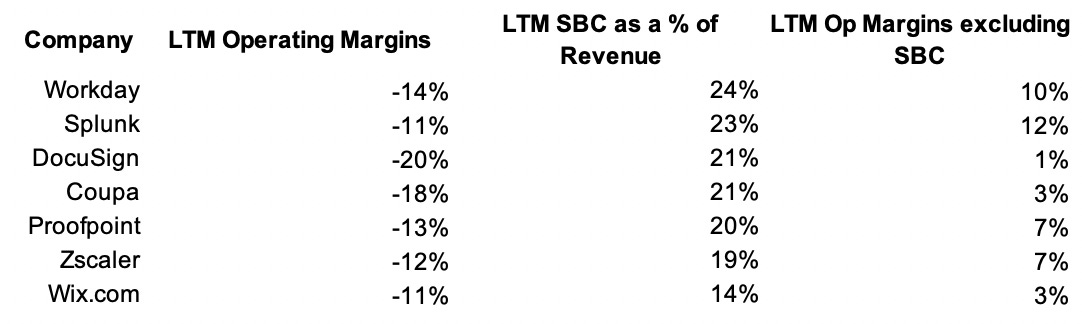

In fact, for companies such as Workday, Splunk, Atlassian, and Okta, stock-based compensation is the difference between the company being unprofitable on a GAAP basis and profitable on a non-GAAP basis, as below.

Most of these companies which tend to exclude stock-based compensation in their adjusted earnings provides some rationale as follow:

[Company] excludes stock-based compensation expense because it is non-cash in nature and excluding this expense provides meaningful supplemental information regarding our operational performance and allows investors the ability to make more meaningful comparisons between our operating results and those of other companies.

Are they right?

I think there are two things to unpack here: one, is SBC a real expense which should be accounted for as one, and two, is it okay to provide non-GAAP estimates which exclude SBC at some stage in the life of a company.

Now, on the first one, I believe stock-based compensation is absolutely a real expense that should be accounted for and the GAAP standards are correct on this front.

Warren Buffett puts it best:

“If options aren’t a form of compensation, what are they? If compensation isn’t an expense, what is it? And, if expenses shouldn’t go into the calculation of earnings, where in the world should they go?”

As many of these companies themselves mention, they reward employees with stock in order to attract and retain talent. Now, if they didn’t provide them with that stock, they would instead have to give them cash in order to attract and retain them, which would obviously have been expensed. So why should it be different here? Sure, there is a question around what the right way to value those options is when granted, but that they should be expensed should not be up for debate.

Of note here are the statements made by Facebook and Google, which earlier excluded these items from non-GAAP earnings, but changed their stance in early 2017.

Here’s what Facebook had to say (emphasis mine)

Before diving into the financials, I want to highlight that we are no longer reporting Non-GAAP expenses, income, tax rate or EPS. Given that stock is an important part of our compensation structure, we believe that investors should focus on our financial performance with stock-based compensation included.

And here is what Google had to say (emphasis mine)

SBC [stock-based compensation] has always been an important part of how we reward our employees in a way that aligns their interests with those of all shareholders. Although it’s not a cash expense, we consider it to be a real cost of running our business because SBC is critical to our ability to attract and retain the best talent in the world. Starting with our first quarter results for 2017, we will no longer regularly exclude stock-based compensation expense from Non-GAAP results

Other large tech companies such as Microsoft and Apple always favored the use of GAAP earnings and didn’t adjust to remove for SBC.

Hopefully it is clear that SBC is a real expense which a company will incur in the long-term, and so the long-term operating margins will be affected by it.

Now, is it wrong to provide non-GAAP estimates which exclude SBC?

Typically investors want to know the real performance of a company. Non-GAAP earnings can be useful in determining that by adjusting for some noisy one-time or similar expenses which may not occur in the future.

SBC is obviously an expense that will reoccur over time. However, as a company grows, it might reduce SBC from large numbers as a percent of revenue to much smaller numbers in steady-state. For that reason, I think it is generally okay to provide non-GAAP earnings without SBC if SBC is rapidly changing over time and communicate it to shareholders appropriately. However, it would be even better if companies instead just communicate how they expect SBC as a percentage of revenue to look like in the future or long-term.

But if a company is close to steady-state in terms of its stock-based compensation as a percentage of revenue, to exclude it in non-GAAP earnings and suggest that non-GAAP earnings better represent their long-term performance is egregious if not misleading.

Investors should do their diligence on where they expect a company’s long-term SBC to be, and use that to come up with the long-term margin profile of the company.

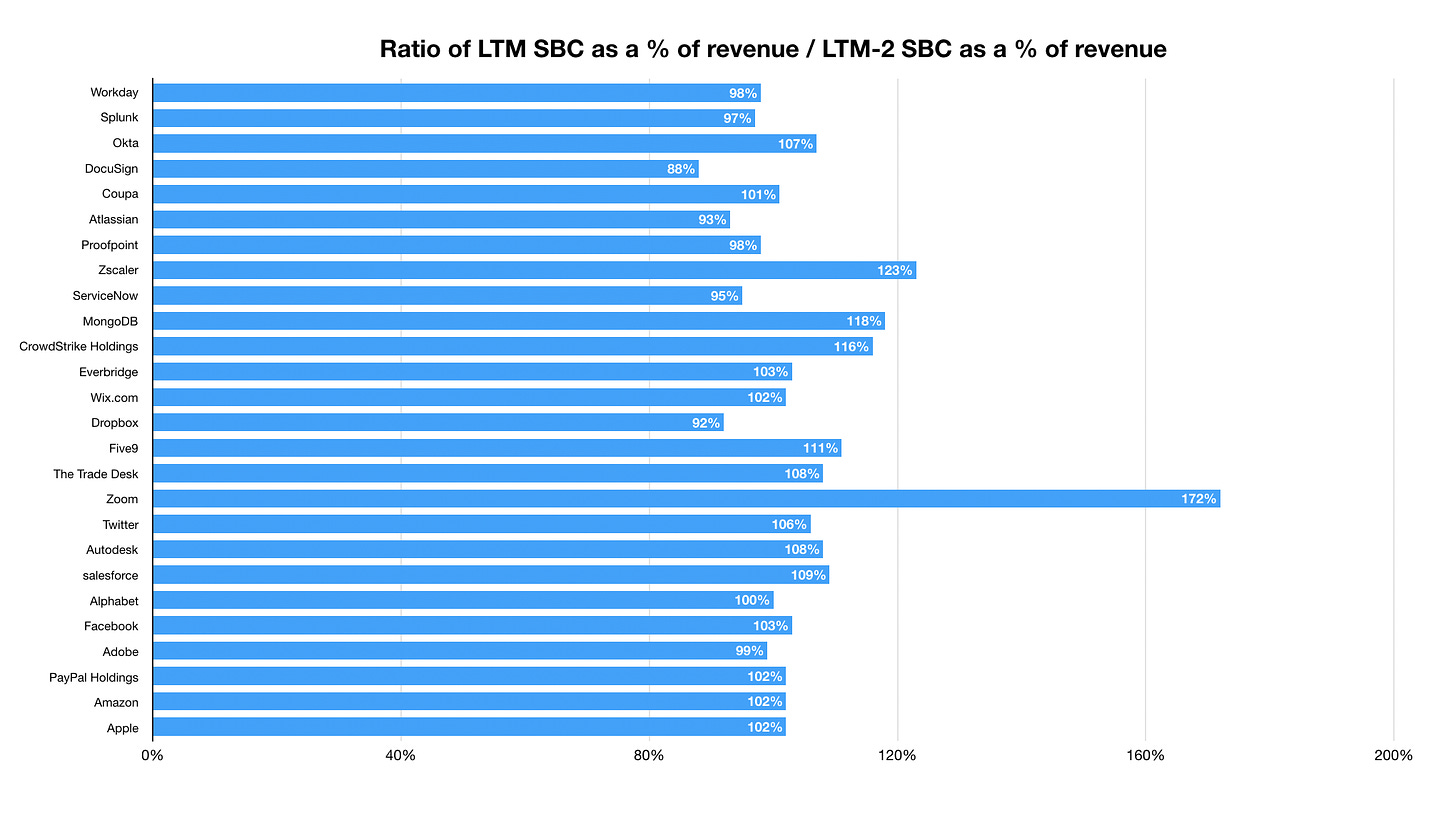

In closing, here’s a quick graph which shows what the SBC as a percentage of revenue was in the last twelve months vs two years prior. A number under a hundred suggests that SBC as a percentage of revenue has decreased compared to two years ago and vice versa. As you can see, for most companies SBC as a percentage of revenue is in the 90-110% range, meaning it hasn’t changed much from two years ago.

from Hacker News https://ift.tt/2TDTSQA

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.